Broke-Ass Financial Coaching: How to Stop Getting Ripped Off

My first post was called “Face it!” I want you to feel empowered financially and the most difficult steps are commonly the first few. What financial issue or challenge are you not facing? Do you want to have a breakthrough with your relationship with money? I would start by facing something that feels difficult.

I get lots of questions about how to “get a good deal,” and “not get screwed.”

Take responsibility and ownership. Your financial life and future is your responsibility.

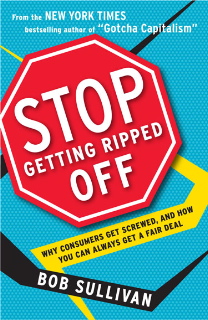

I recommend to anyone and everyone who wants to be an empowered consumer, read Bob Sullivan’s book “Stop getting ripped off: Why consumers get screwed, and how you can always get a fair deal.”

If you don’t want to read the whole book, click on these sections from his book, provided by www.stopgettingrippedoff.net, such as:

.

Everyone needs to read this.

Knowledge is power. Also, let’s help each other out. Please share your comments, thoughts, and “result examples” below in the comment section. Share with each other what is working, where you are getting fair treatment and deals in SF and NYC. I especially would like for us to share which banks offer a checking account with NO overdraft protection, not even “courtesy” or “automatic” overdraft protection. So if you use a debit card and there is no money in the account, then the debit card gets denied, and you don’t get slammed with ridiculous overdraft charges.

Here is the hitch…

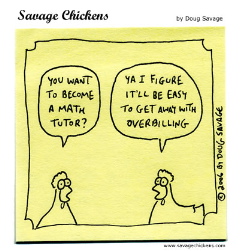

Many people in our culture do not have basic confidence with quantitative life skills. Mathematical illiteracy, known as innumeracy, is a huge problem. Have you ever bragged that “you suck at math,” and you don’t care because you have your cell phone calculator? In our culture there is a totally different stigma associated with illiteracy and innumeracy.

If you have ever shook your head when you saw someone buy something from a company that oppresses or takes advantage of them, you need to look at yourself in the mirror first. How much is your bank charging you for your checking account? ATM fees? Credit card interest? How much interest are you paying on that loan? In total, not the monthly payment.

I had a huge coaching breakthrough recently. I was coaching a client who has spent over $2500 in the last two years on overdraft charges. I have been coaching her that whole time. We have gone through all my tricks and tips to overcome this challenge. Nothing worked. Then I asked her how her confidence with math was. She said that she has low confidence with math; she gets really confused and overwhelmed.

You may feel the way my client does about math. If you do, you are not alone.

The 2003 U.S. Department of Education’s National Center for Education Statistics ran a test of Adult Literacy, and one third of the test dealt with “quantitative literacy.”

Sullivan Says, “Only one in seven Americans qualified as ‘proficient.’ That means that only one in seven Americans can reliably perform tasks such as these:

– Calculate the yearly cost of a specified amount of life insurance, using a table that gives cost by month for each $1,000 of coverage.

– Calculate an employee’s share of health insurance costs for a year, using a table that shows how the employee’s monthly cost varies with income and family size”

Ever wonder why that joker didn’t throw in enough money at a group dinner? Frankly, I just judged them and assumed they were doing it intentionally. Turns out that a lot (not all, there are still some jokers out there) of those people do the math wrong.

I am not suggesting that you go through all the standard math classes again, aaaaaahhhhhhh! Although if you feel inspired, do it. Bob Sullivan provides many examples of some simple short cuts that apply to quantitative life questions, so check out the book and his site.

If you know of any Adult “Life Math” or personal finance math classes in SF or NY please email me or post a comment here on the site.

It is time to face it! It doesn’t matter what anyone else thinks, this is your life and if you need some help with your life math skills, great! Let’s encourage each other to improve our math skills and empower ourselves as consumers.

coachsizzle@brokeassstuart.com