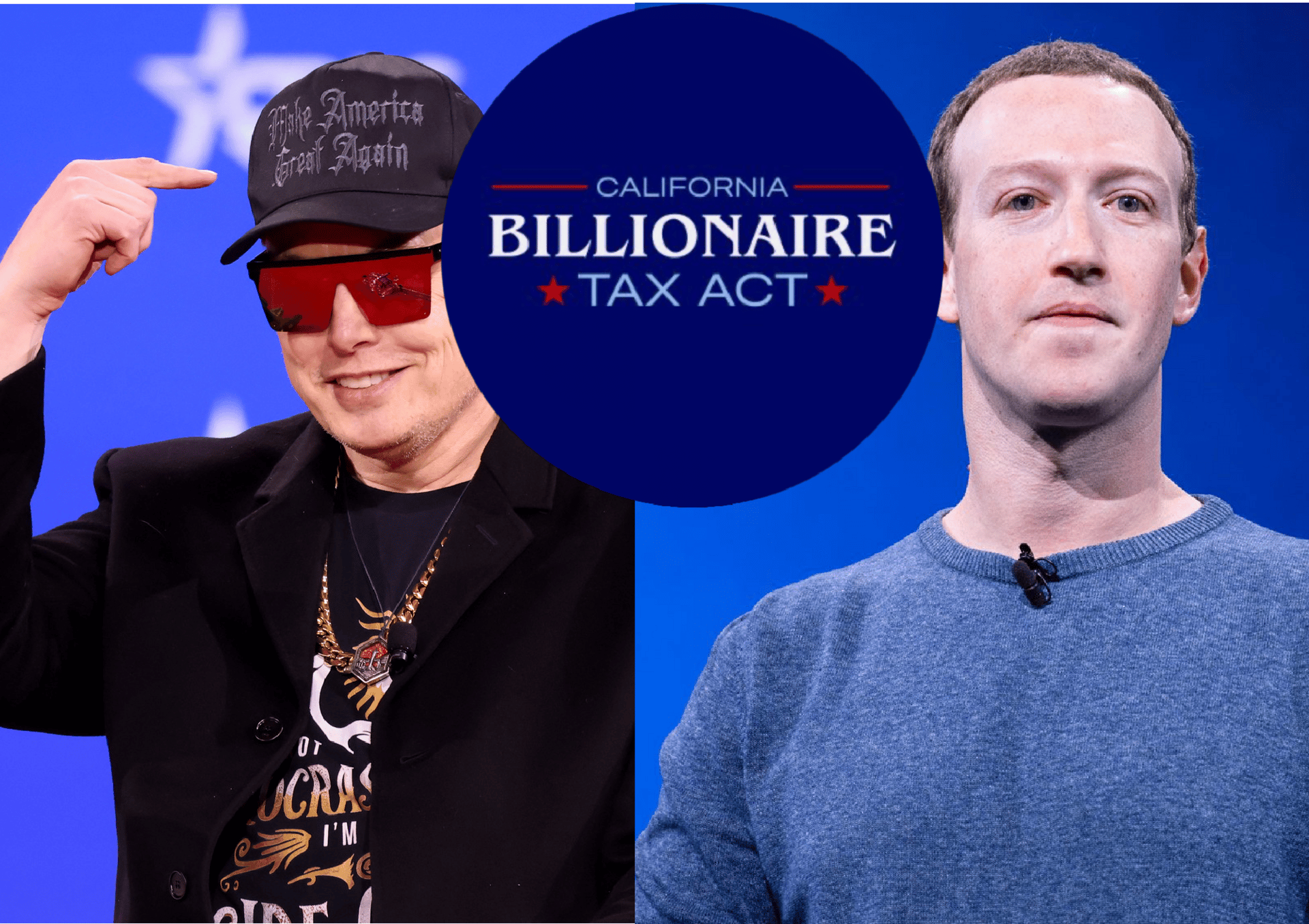

Photo of Musk by Gage Skidmore. Photo of Zuckerberg by Anurag R Dubey

A potential Billionaire Tax Act may be in the works for California’s ultra-wealthy. Two figures, St. John’s Community Health President and CEO Jim Mangia and Service Employees International Union Chief of Staff Suzanne Jimenez, filed to obtain a title for the proposed act. The process is part of circulating petitions for its consideration. Their proposal calls for a one-time emergency 5% tax on California residents whose wealth exceeds $1 billion. The tax would pull from assets such as stocks, artwork, classic vehicles, antiques, collectibles, and intellectual property rights instead of income. Directly-owned real-estate is excluded. Mangia and Jimenez submitted their request October 22, 2025.

Asking nicely

A September press release stated that California is facing approximately $100 billion in federal healthcare funding cuts over the next five years. This may precipitate the loss of some 145,000 healthcare jobs. Proponents of the Billionaire Tax Act declare the legislation would generate the monies needed to secure the State's healthcare budget. The objective: to bridge the gap carved by cuts in federal funding for California’s healthcare and educational infrastructure, the result of the Trump regime's One Big Beautiful Bill Act.

The Service Employees International Union (SEIU) is asking nicely for California’s billionaires to part with 5% of their riches, once. Five percent of one billion is five hundred million. In any case, Governor Gavin Newsom has been annoyingly hesitant to raise taxes on the Golden State’s most wealthy residents. I suppose we should sympathize. If you were vying for the Oval Office, would you alienate your richest friends?

The SEIU decided at any rate that a ballot measure is our best shot at protecting healthcare and education in California. Recently at a press conference, SEIU-UHW President Dave Regan stated, “We are facing literally a collapse of our healthcare system here in California and elsewhere. [The billionaire tax] will help us keep healthcare facilities open. It will stabilize premiums and coverage for all Californians, protect healthcare jobs, and also improve public education.”

Predictable political pushback

Naturally, Gov. Newsom is against the initiative, according to a campaign spokesman, and has called the initiative “bad policy,” and, “an attempt to grab money for special purposes.” Though Newsom hasn’t yet launched an opposition campaign, longtime consultants Dan Newman and Brian Brokaw have founded Stop The Squeeze, a political action committee sworn to thwarting the proposed tax.

North Carolina State University tax professor Nathan Goldman weighed the pros and cons of the Billionaire Tax Act in one Forbes article. Per his estimations, the roughly 200 billionaires living in California could easily afford to foot the bill. Imagine—0.00005% of California’s population could cover the State's healthcare and education costs without losing a single CEO. Just the way they like it. If they’ve learned anything, they’ll realize they can’t have their multibillion-dollar cake and eat it too.

Take Facebook and Meta CEO Mark Zuckerberg for example. According to Forbes, his net worth as of October 2025 is $251 billion. If he were subject to a five percent tax on his net worth, that would only subtract $12.5 billion, which still leaves him with more than $200 billion. Poor fella.

Goldman also warns that the Billionaire Tax Act could cause billionaires to flee California, citing Jeff Bezos as an example. The profanely rich man abandoned Seattle because Washington had proposed—not implemented, proposed—a one percent tax on individuals whose assets exceed $250 million. Forbes reports that Jeff Bezos has an alleged net worth of $245.9 billion. If he got hit with a one percent wealth tax, he'd pay a mere $2,459,000,000, leaving him with a whopping $243,441,000,000.

Even when Nathan Goldman accounts for capital flight, the arithmetic clearly underscores how greedy a billionaire can get.