San Francisco’s Medical Billing Nightmare: How I Fought Unaccountable Bureaucracy

Photo by Photo by camilo jimenez on Unsplash

by Elliot Mae

Imagine this. You took the wrong dose of a prescribed medication. You’re disoriented and kind of panicking. You have the wherewithal to call Poison Control. Poison Control tells you to call 911. The 911 operator sends a couple of storybook EMTs to your Trendyloin studio apartment. They encourage you to get in their ambulance and go to the hospital. You resist, but they’re irresistible. They assure you your insurance will cover the cost, and something about SF regulation. It’s fuzzy but you’re sure you heard FREE. You acquiesce. One takes you by the elbow and guides you into the truck.

This happened to me. I wonder if those two nice EMTs knew that for six years, the Bureau of Delinquent Revenue Section of the Office of the Treasurer and Tax Collector for the City and County of San Francisco, would send me threatening letters after my one and only ever ambulance ride. They are each signed by a Senior Collections Officer. The most recent letter states:

“You were given ample opportunity to clear your account(s), and you have not done so. Therefore, this office will either initiate legal action or refer your account to a licensed collection agency. This action may affect your credit.”

This letter came two years after the last and was signed by a new Senior Collections Officer (who we will call Mr. SF Collections). I did not realize this bill was outstanding because I never received a response from the city to my emails or calls. I don’t like being ignored, but I really don’t like BS bureaucracy with no accountability preying on the naivete of its constituents.

Local Journalism for Working stiffs

We write for the poets, busboys, and bartenders. We cover workers, not ‘tech’, not the shiny ‘forbes 100 bullshit’. We write about the business on your corner and the beer in your hand. Join the Bay's best newsletter.

Mr. SF Collections responded and offered a 20% discount if I paid in full, meaning they’d reimburse later. I wasn’t satisfied and didn’t trust this department. It seemed ludicrous to me that they can ignore attempts from the payor to resolve and then threaten legal action. It occurred to me that there must be a statute of limitations.

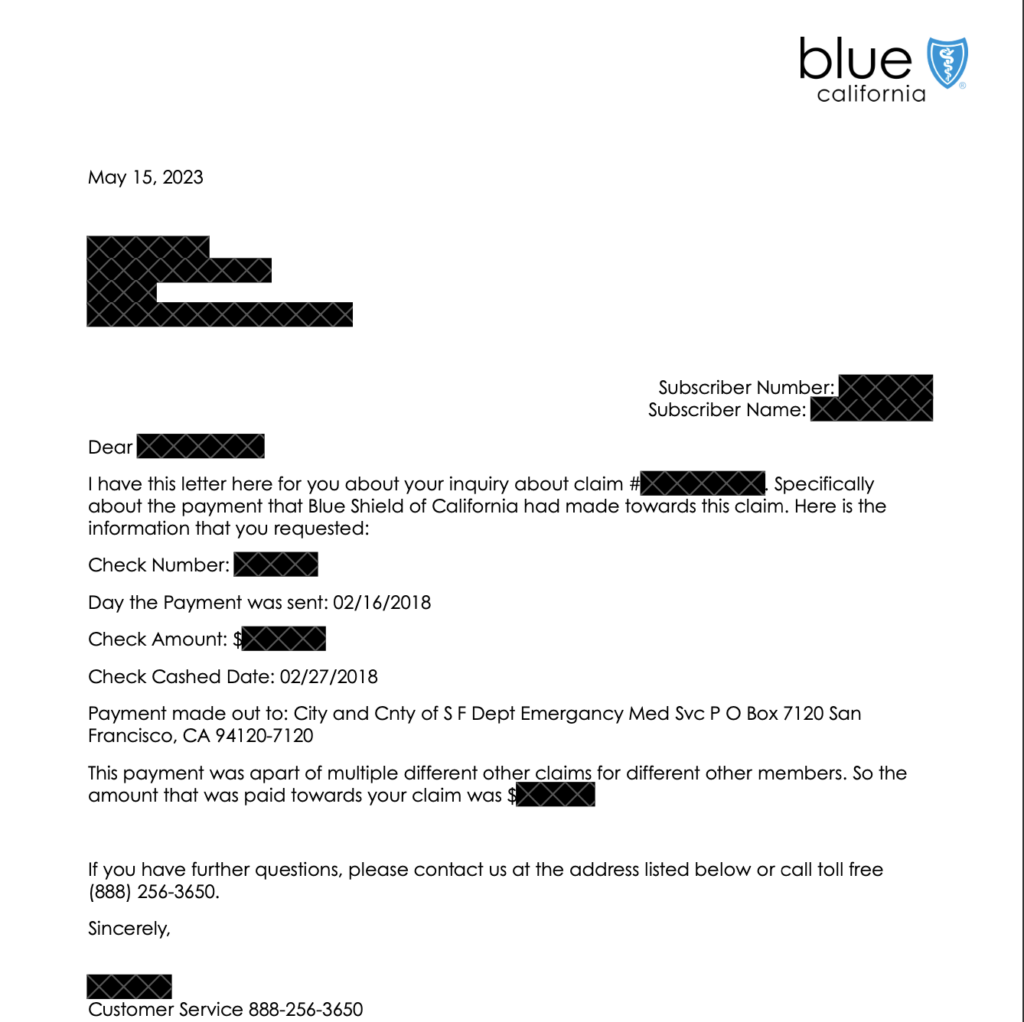

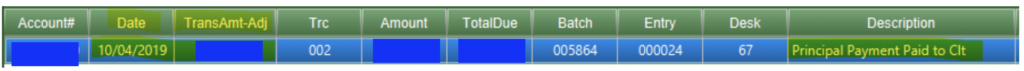

I sent Mr. SF Collections an article I found from Oak Tree Law that said the statute of limitations for medical debt is four years; he cannot legally send me to collections because the statute had lapsed. He then claimed my insurance company paid a bill in 2019, three years and seven months ago, more than two years after the ambulance ride and within the statute of limitations. He sent me a screenshot of the city’s ledger showing that 70% of the bill was “paid” by Blue Shield, my insurance company, in October of 2019.

Screenshot sent by Mr. SF Collections Officer of the city’s ledger showing the date the check was received

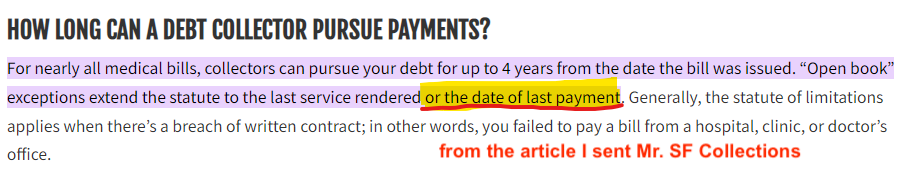

Insurance companies don’t take two years to make payment – it must be a mistake. Mr. SF Collections was adamant that that is when they’d received payment and that the city was within the statute of limitations period to resume collections. He sent me a screenshot from the article that I sent him, highlighting the portion that stated the date of the last payment restarts the statute of limitations.

Screenshot sent by Mr. SF Collections Officer citing and highling the article I sent him. Did he know about the statute before this?

When I asked what would happen if I was unable to pay, instead of advising me to apply for hardship, which the city offers, Mr. SF Collections threatened to send the case to a private collections firm and pursue legal action, again. I reiterated that this is predatory collections, regardless of the exception.

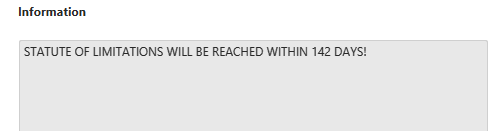

Mr. SF Collections was not phased. He continued to cite the article I sent him and the payment record he had from 2019, when Blue Shield made a payment. He also sent me a screenshot: “Statute of Limitations will be reached in 142 days!” I supposed this was in the city’s computer record. Timing seemed suspect; I realized I better verify the payment.

Screenshot sent by Mr. SF Collections Officer of what must be the city’s tracking system for statute of limitations. (It’s incorrect.)

Blue Shield found the check made out to The City and County of San Francisco for my bill, dated February 2018, which was five years ago and outside of the statute of limitations. According to the Blue Shield representative, these checks are often sent on behalf of multiple subscribers. This may explain why it took so long for the city to log, but it doesn’t excuse the Treasurer’s lackluster bookkeeping. The date in the system should be the date of the check, not the date it was logged.

According to a survey done by the Consumer Finance Protection Bureau, one in four Americans have medical debt; it is the most common tradeline on credit reports. Residents of San Francisco who have taken an ambulance and are unclear on billing are surely experiencing something similar to what I experienced. Is the city in the collections business?

This behavior of harassing citizens, bad bookkeeping, ignoring statutes of limitations and general lack of accountability is unacceptable. The topic of healthcare in this country is enormous. The costs and rigmarole alone needed to navigate insurance and billing are overwhelming, to say the least. Many people do not have the resources or background to even know how to get help or research this type of financial demand. What if we went back and looked at all the people who had been sent to collections from the Bureau of Delinquent Revenue Section; would we find that these notices were sent after the statute of limitations had expired because the city’s ledger is not up to date?

Mr. SF Collections has not responded after he offered me a greater discount and affirmed that I still owe. He never said he wouldn’t send me to collections. I emailed José Cisneros, SF Treasurer. I asked for his comment on inaccurate accounting resulting in harassment of tax-payer base, violation of statute of limitations of medical collections and lack of accountability from this city department when the evidence was clearly presented. After playing phone tag for a couple weeks, a supervisor called me back. She was very calm and understanding; she seemed a little scared. She did confirm they would not be sending me to collections and said she would follow up with Mr. SF Collections.

My suggestions to anyone dealing with a billing issue:

1. Document everything: If you email, save it. If you speak to someone on the phone, take notes. You can email yourself those notes as part of the thread to keep everything in one place and date.

2. Check the facts: If you get a bill, call your insurance and try to understand exactly what is covered. If it’s been a long time since the bill date, research the statute of limitations on the type of bill.

3. Cite relevant protections. Here are a couple:

a. The Fair Debt Collection Practices Act. This act establishes legal protection for consumers from abusive debt practices. Its premise is: “There is abundant evidence of the use of abusive, deceptive, and unfair debt collection practices by many debt collectors. Abusive debt collection practices contribute to the number of personal bankruptcies, to marital instability, to the loss of jobs, and to invasions of individual privacy.”

b. The No Surprises Act protects against surprise medical bills. It says that private insurance companies cannot pass along surprise bills that are not covered. It says the insurance company and the biller must negotiate or arbitrate a settlement.

4. Contact the Consumer Protection Financial Bureau.

5. Seek free legal help: Some firms offer a free consultation. Allow yourself enough time to hear back. It can take a while.

6. Try to negotiate an affordable settlement.

7. See if you qualify for financial hardship.

8. Do everything you can to keep it from going to collections.

*I am not an attorney. This is not legal advice. Please seek a qualified attorney or resource if you are in need of legal advice.