This is How Hard it is to Open a Small Business in San Francisco

By Sophie Robbie, written with Jetta Rae Robertson

To live in San Francisco is to subject yourself to some pretty absurd questions. What kind of person tries to rent half a staircase for $900? How is that legal? How desperate would you have to be to make that offer? Also…could I make it work?

I moved to SF from Los Angeles in 1997. I attended beauty school at SFIEC, the Paul Mitchell school. I built an independent hair stylist business in the Mission District. The work is not quite so glamorous as you might think, at least not on this side of the chair. Still, I had a job I was passionate about, which not many in the city can say they do. Sometimes that’s all you have at the end of the day.

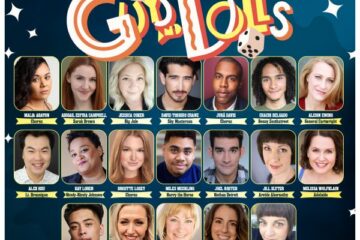

As my skills grew, so did my opportunities. I was a hair and makeup artist at SF Opera, SF Ballet, and even worked on a Broadway production at the Curran Theatre. I became a member of IATSE local 706 hairstylist and makeup guild. You know the story. Years and years of hard work and networking and taking life’s nonsense on the chin was finally paying off.

Then the pandemic hit.

In 2020, the Broadway play was closed and all salons in the city were banned from operation. As the rest of the country slowly resumed business, the city persisted with a prohibition on the service sector.

Like most hairdressers who hadn’t moved away or quit, I resorted to doing my clients’ hair in their backyards, rinsing their color off with a garden hose.

10 months of house calls just to survive was wearing me down physically and financially. I was lucky to have a family member who helped me pay some of my rent to keep my rental record clear – God forbid a potential landlord sees that you are susceptible to global economic disruption.

In shutdown, I started learning more about marketing for hairstylists. So many of my clients and fellow stylists had moved away; it would be like starting all over again, proving my skills to a whole new set of clients.

I took courses. I joined online discussion groups. I rented a chair at a salon and began building myself back up. I revamped my website, honed in my niche – all in a seemingly inescapable recession.

Despite all that, in my first year, I was able to attract over 75 new clients to my small business.

Just as I was regaining my footing, the salon I was renting went up for sale and sold almost immediately. But all wasn’t as dire as it seemed; the city began unrolling grant programs like Vacant to Vibrant to help small businesses like me stay in the city where we’ve made our home. San Francisco was offering up to $25,000 to open a new storefront space in certain parts of SF. I felt this was my chance to get a good spot while the market is soft and then build up my retail business alongside my service business. I figured since I had an established business with strong sales and proven marketing that I would be considered a good candidate especially with the $25k city grant. I was mistaken.

I don’t have great credit, and I was not flush with savings since I hadn’t recovered financially from the pandemic closures. I’m not sure if anyone did. So many salons have gone out of business leaving behind empty, expensive shells.

A staircase to nowhere that was being rented out for $900 a month in SF. Photo via Craigslist

I was really relying on the city grant to help me overcome the hurdles the post-pandemic economy had placed on me. But just like I was counting on that grant to be my lifesaver, landlords were expecting that grant to maintain their own way of doing business.

I viewed a “start up” space on the tragic block of Church near Market, one with a bathroom accessible through a staircase with an entrance in the adjacent property. When I asked the realtor about issues resulting from the ADA non-compliance, she said “You will get sued, so make sure you carry good insurance”. This person was asking $2,000 a month for 500 square feet.

The next space I almost rented was a 500 square foot previous salon on Guerrero and 16th St. The landlord bragged about owning the building for 45 years. He also told me “Don’t worry about ADA compliance, they won’t care about the bathroom”. He wanted $2500 a month, and only after I would agree to take the responsibility of $50,000 of ADA upgrades that would take almost a year of construction and permitting. These updates were due in 2012. This landlord was, of course, very eager to help me secure the city grant, as he didn’t want there to be any disruption to his income stream.

And there’s the perfect little shack. A literal 1907 shack on 21st in the Mission, also a former hair salon. 600 square feet, almost $2500 a month. It was dirty, with a very low ceiling, but I could have made it work. This was all I needed to bounce back and begin rebuilding not only my business but San Francisco’s post-pandemic economy.

After an extensive application process lasting weeks, I was ultimately denied tenancy because the landlord thought I “could have a little more savings” – my existing business sales from over 300 clients and the $25,000 city grant was not enough guaranteed income for her. Her representative asked if I could get a wealthy relative to add my name to their bank account so I could misrepresent my finances.

Something I need to stress here: I’m not cheap. On average, I cost about $100 an hour. Someone asking me to fluff my numbers to look more successful has no idea what a small business looks like.

I have spoken with no less than 10 different real estate agents about my search for a small business space; not one ever reached out with a viable (less than $3000 a month) option. While I could move to the Tenderloin or Union Square, even a slight change in neighborhoods could alienate many of my clients and devastate my business all over again.

These rents don’t reflect the vacancy rate of 35%, which rose in the last quarter. Landlords and realtors in the city are hoping these city grants can help them maintain the projected value of their properties with no regard for the needs or economic health of the city.

So, who would rent a $900 staircase? Or a $2000 salon space with a guaranteed ADA lawsuit? San Francisco poses a lot of absurd questions, but the answer is pretty mundane: this town only loves small business if it’s trust-funded.