Finance

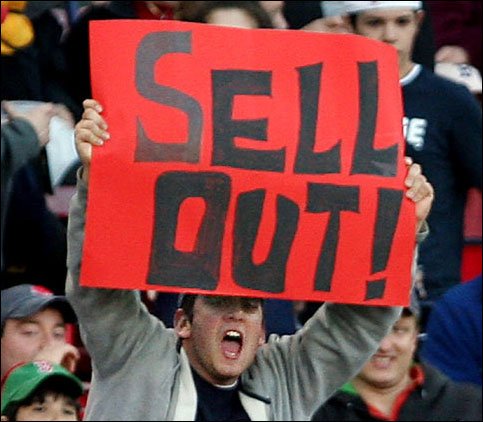

Broke-Ass Financial Coaching: Are You a Sell Out?

The story that we commonly buy into is that in order to get “x” thing that we want, we need to “sell out,” give up our dreams and work for a company that we don’t believe in. That is not absolutely true, just like following your dreams does not mean you have to be broke. What’s worse is that some of you feel like you are “selling out,” AND you are broke. What if you could do what you love AND thrive in all areas in life? Don’t be a naysayer. If you are reading this and it pisses you off, are you looking for reasons that I could be right about this or all the reasons I am wrong?

Broke-Ass Financial Coaching: Shameful Spending

I am not a mental health professional or a therapist, and I am in no position to tell someone whether I think they are “addicted” to gambling or anything for that matter. In this case and in many cases I recommend clients seek professional guidance and support. If you feel like your spending in a specific area may be a problem then it is worth addressing seriously. Even if a professional tells you that you are not technically “addicted” to something, if you feel like it is something that is creating challenges in your life or keeping you from how you would like to feel or live, then look at it, confide in a friend, and ask for help.

Broke-Ass Financial Coaching: Just Ask for FREE Stuff

I was 23 and I won a sales contest and the prize was reimbursement for electronics. I went to Best Buy knowing what I wanted to buy. I picked out what I wanted, a small tv, dvd player and a camcorder, yes this was a few years ago. I asked the sales guy, “if I buy these things here, what could you give me for free?” Now I have asked for specific things for free at times, like when I bought a washer and dryer, I asked for 3 dvds for free and they worked some magic on the computer and gave them to me.

Don’t Spend Diddly This Tax Day And Still Have a Good Time in New York

Call me unAmerican, but I’m tired of handing over my hard-earned cash to the government so it can make my financial decisions. As a new small-business owner, this is the first year since I started working way back in the mid- to late-1990s that I haven’t received some kind of

Broke-Ass Financial Coaching: Cheap Ways to Get an Education

It can feel daunting to think about how to come up with the time and the funds to educate yourself. Also, maybe you love to learn and you are an experiential learner or in some other way not perfectly designed for traditional schooling. Maybe you love traditional schooling. Either way, let’s find some ideas for a Broke Ass Education.

Broke Ass Financial Coaching: Last Minute Taxes

“Coach Sizzle, I haven’t done my taxes, do you have any suggestions for last minute tax prep?” – SC

Woohoo tax time! For those of you who get money back.. I’m sure you are super stoked! Get it done! If you owe money, get it done, rip off the band aid. I know it is painful especially if you have not saved for your taxes.

Cheap Hair Care: Mane ‘n Tail

I’m on the left! I have great hair. Unfortunately, it took me losing all of it to a particularly gnarly bout of cancer to really appreciate it. (Don’t worry; this isn’t going to be some faux-inspirational survival story where I pat myself on the back for making it through chemo

Broke-Ass Financial Coaching: Financial Skeletons

“Coach Sizzle, my boyfriend just proposed to me and I said yes, yay! I have not shared with him the full extent of my financial situation, I’m feeling weird about it and I don’t know how to handle it. What should I do?” – MM

There are some things you want to share with your partner. You are concerned about his reaction and you want to have an authentic relationship. Here is where I would start: