taxes

The ‘Overpaid CEO Tax’ Will be on SF’s November Ballot

Tech companies are striking it rich during the coronavirus pandemic, while the working class is stuck in dire financial straits. But our dystopian Dickens-novel “Best of times, worst of times” phenomenon that has plagued San Francisco for years could change thanks to a piece of legislation just approved by the

Which Bay Area Tech Companies Pay No Corporate Taxes?

The spectacular wealth of Bay Area tech firms is driving up the cost of everything from your rent to a loaf of bread. But many of these companies are paying nothing whatsoever in federal taxes, racking up billions in profits while homelessness runs rampant, our infrastructure is crumbling, and income

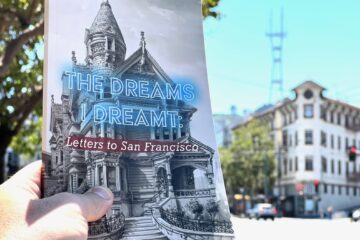

This New Literary Magazine is a Gift to the People of San Francisco

I’ve got some awesome news! We received a grant from the Civic Joy Fund to put out a literary magazine celebrating SF and acting to counter the stupid “Doom Loop” narrative. It’s a gift to the people of San Francisco. And after months of working on this project it’s now available

Tax and Flu Season Feel the Same

The last time I felt this nauseated, angry and anxious was when I had morning sickness. I never threw up over homework assignments in high school. Not even when I was a sleep deprived, hormonal, overachiever taking an absurd amount of AP classes. I’m not pregnant, I don’t have the flu,

What Massive Marijuana Tax Revenue Can Buy California

The potential tax revenue from legal marijuana in California will dwarf both Colorado & Washington. We calculated the things CA could do for teachers, the homeless, & healthcare with the new revenue

7 Tax Tips to Avoid Headaches and Costly Mistakes

Understand the difference between 1099 and W-2 income and how to use them to your advantage. Most broke-asses work multiple jobs. For some you may be classified as an employee (W-2) and others as an independent contractor or self-employed (1099). Always ask when you start a new job!

How to Do Tax Returns if You’re Self Employed and Broke

Guest post by John Gillingham, a San Francisco CPA specializing in small business taxes at Gillingham CPA and makes apps to teach accounting and taxes. Taxes suck. So you are driving around a pink mustached Lyft in order to follow your creative, but less profitable pursuits. Maybe you illegally rent

Is Your Way of Thinking Keeping You Broke?

Getting Out of a Broke State of Mind “More money, more problems.” That’s only what rich people say. Broke people have “broke-people problems.” These are much harder to climb out of. I didn’t realize it at the time, but money scared and overwhelmed me for years. Watching my parents struggle,

The Broke-Ass Middle Class

The first time I felt like a New Yorker was subtle but significant. It happened when I went out to buy ice cream and refused, for the first time, to walk the extra two blocks to the next bodega, where the ice cream was cheaper by a dollar. Finally lulled